Partnervest

The recent collapse of Silicon Valley Bank (SVB) and takeover of Credit Suisse by UBS has reminded investors of the unpredictability of financial markets. While these events have been largely contained through policy responses, they serve as a reminder of the risks inherent in investing. They also highlight the importance of diversification and risk management in mitigating these risks.

In this article, we’ll explore the recent banking crisis and its implications for asset allocation, highlighting the importance of diversification, risk management, and a long-term perspective.

Silicon Valley Banks Collapse and its Impact on Markets

The collapse of Silicon Valley Bank is a cautionary tale for investors about the importance of asset allocation and risk management. Over the course of the COVID pandemic, the bank saw deposits from customers in northern California’s high-tech industry triple. To capitalise on this growth, SVB invested heavily in US government bonds, intending to hold them until maturity. However, inflation and a downturn in the tech industry led to many customers withdrawing their deposits and the bank was forced to sell its bonds at a loss to cover these withdrawals. This reduced market confidence in the bank, leading to further withdrawals by depositors worried about a potential collapse. Ultimately, fear of a collapse became a self-fulfilling prophecy, resulting in the bank’s failure.

The unexpected collapse of Silicon Valley Bank (SVB) had a significant impact on fixed income markets. In the weeks following the collapse, sharp moves at the front end of the yield curve led to a significant plunge in Treasury yields. Two-year yields dropped 60 basis points (bps) on March 13, the biggest drop in two-year US Treasury yields since the 1980s.

Exhibit 1: Seven Sigma Move on the Front End of the Yield Curve

Sources: Bloomberg, Macrobond. Past performance is not an indicator or guarantee of future results. See www.franklintempletondatasources.com for additional data provider information.

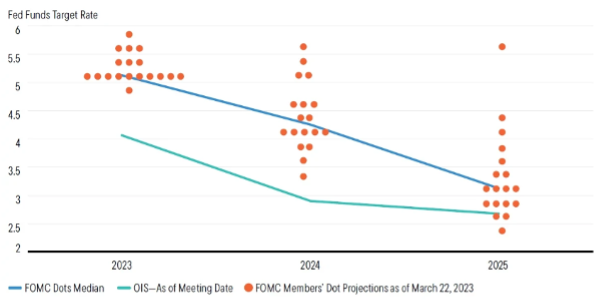

Investors viewed this as a signal that the Federal Reserve (Fed) was wrong and should cut rates immediately. The Fed and fixed income markets differed significantly in their assessment of the appropriate level for the terminal interest rate, with the gap between the market and the Federal Open Market Committee projections increasing to over 100 bps. The divergence is important for investors, as expected fixed income returns are dependent on which of these two paths will eventually materialise.

Exhibit 2: Tug of War Between the Fed and Markets

Source: Bloomberg, Macrobond

The banking crisis had a significant impact on money markets as well. The chart in Exhibit 3 shows the increasing switch out of bank deposits and into money market mutual funds. US deposit rates have started to rise, but they remain below money market mutual fund yields, implying that outflows of bank deposits will likely continue. This deposit flight may cause banks to either continue to raise rates to maintain deposit levels or to restrict lending.

Exhibit 3: Money Markets In, Bank Deposits Out

One common factor underpinning the recent US bank failures has been the impact of higher interest rates on government bonds. Banks are attracted to bonds due to their low default risk, but rising interest rates can lower the value of existing bonds, leading to losses when they are sold. This was a key factor in the collapse of Silicon Valley Bank, which had invested heavily in US government bonds and was forced to sell them at a loss to cover withdrawals. Had the bank been better able to manage ins interest rate risk, whether through hedging or diversification, it likely would have been better positioned to weather the deposit outflows it experienced and potentially avoided collapse.

The Value of a Long-Term Approach to Asset Allocation

Asset allocation refers to the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash. The goal is to achieve a balance between risk and return that aligns with an investor’s goals and risk tolerance. By diversifying across different asset classes, investors can reduce their exposure to individual security or sector risks and likely smooth out the ups and downs of the market.

Asset allocation is not a one-size-fits-all approach and must be tailored to an investor’s goals and risk tolerance. It’s also important to remember that no investment is entirely risk-free, and market movements can sometimes be unpredictable. However, by diversifying across different asset classes, sectors, and geographies, investors can reduce their exposure to individual risks and achieve more consistent returns over the long term. Risk management strategies, such rebalancing portfolios regularly, can also help mitigate the impact of market volatility.

The recent banking crisis serves as a reminder of the importance of asset allocation and risk management in achieving long-term investment goals. While unexpected events can sometimes disrupt even the best-laid plans, a diversified portfolio that balances risk and return can help investors weather market volatility and achieve consistent returns over time. By taking a long-term approach and staying committed to their investment plan, investors can build a more secure financial future.

Partnervest – Building Diversified Portfolios

At Partnervest, we offer portfolios designed to provide diversification based on a careful analysis of the underlying exposures within. These portfolios are then adjusted to consider the relative attractiveness of each asset class given the prevailing economic conditions, whilst maintaining targeted risk and return parameters.

Our online platform is designed to make it easy for you to allocate your cash to a portfolio of carefully selected investment products designed to harness the benefits of diversification, and specified to target risk and volatility levels. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference.

To learn more about how Partnervest can help you build your financial future, contact Serg Premier 1300 734 496 or email [email protected].

Authors: Stephen Dover, CFA Chief Investment Strategist Head of Franklin Templeton Institute – Partnervest is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827)

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au. In accordance with the Design and Distribution Obligations and Product Interventions Powers requirements, we maintain Target Market Determinations (TMD) for each of our Funds. All documents can be found via www.franklintempleton.com.au or by calling 1800 673 776.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

SHARE:

An unexpected crisis demonstrates the value of intelligent asset allocation