The numbers are in: you’ve copped a pay cut, and you might not even know it.

In the lead up to the federal election in May this year, you’re going to hear a lot of talk of wages, inflation, cost of living, unemployment, and productivity.

There’ll be tables and tables of numbers in the millions and billions. There’ll be all manner of different ways to plot those numbers on graphs.

There’ll be lots of technical terms thrown around. The Reserve Bank will pop up. As will the Australian Bureau of Statistics. There’s the Consumer Price Index and the Wages Price Index. And don’t forget the Living Cost Indexes.

If you’re already lost in the numbers, you’re not the only one. Especially when the words used to describe those numbers – and the society those numbers aim to reflect – can be used in a way that can be purposely vague and misleading.

Politicians, like Scott Morrison, want you to get lost in the numbers. Because often those numbers reveal things they don’t want you to know.

For example, in the last year, millions of Australian workers had a pay cut without even knowing it.

What do all the numbers and the indices really mean for your wages?

Before we continue, let’s have a quick and easy look at how wage growth is calculated in Australia.

The Wage Price Index aims to measure the changes in the price of labour – or the cost of your wages. The Consumer Price Index measures changes in household expenditure – commonly known as inflation.

It’s not perfect, and there are other ways of doing it, but we can measure wage growth (or reduction) in real terms by comparing these two indexes.

Put simply, economists compare wage growth to inflation because when inflation increases, the cost of everything increases. When inflation grows faster than wages do, workers must pay more simply to live.

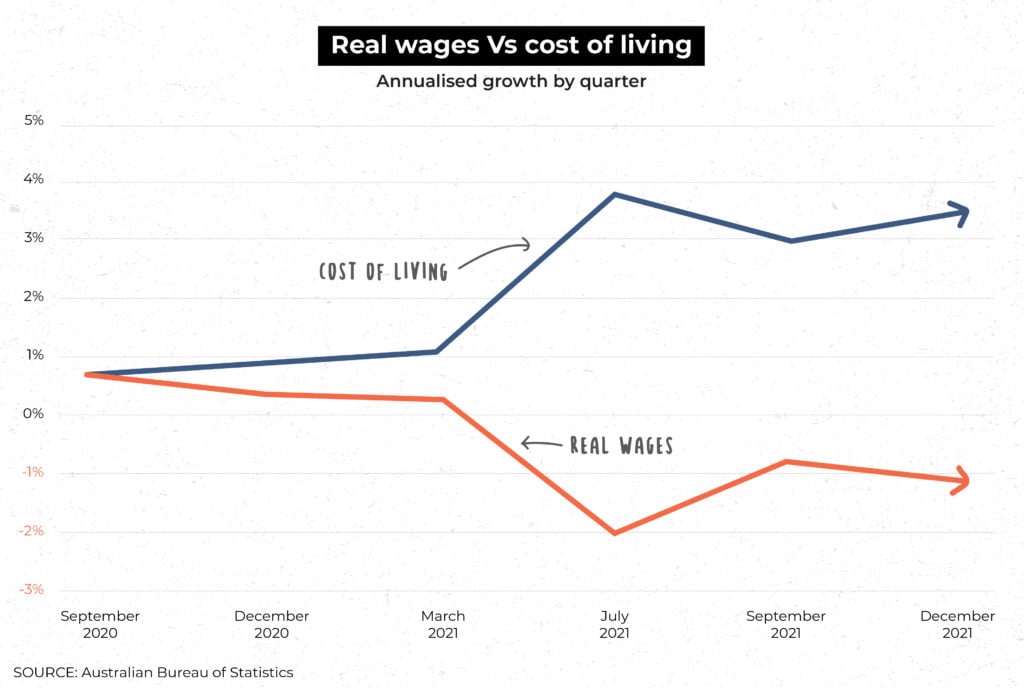

The latest data released by the Australian Bureau of Statistics for both these indexes show that, in real terms, wages in Australia are going backwards. Inflation for 2021 was 3.5%, while wages only increased by 2.3% over that same time.

So with that in mind, let’s take the average Australian worker who earns an annual income of $68,000. Once you adjust for inflation, they’ve actually copped a pay cut of $832 last year.

A worker on $50,000 a year lost $612. And a worker on $90,000 a year effectively receives a pay cut of $1,100.

These are the worst pay cuts workers have experienced in more than 20 years.

For Australian workers, those numbers are frightening. Because as wages go down, the cost of living continues to rise. And a worsening cost of living is felt harder by already vulnerable people.

Cost of living impacts different people in different ways

Rising living costs for millions of Australian workers is no laughing matter.

The Living Cost Indexes measure how the price of goods and services impacts living costs for certain households, including employees, pensioners and beneficiaries, aged pensioners, other government transfer recipients (like those on income support payments), and self-funded retirees. The aim is to see if these households are keeping up with price changes.

The short answer is no.

In 2021, the cost of living went up by between 2.6% and 3.4% for all five of those households. Insurance has gone up. Grocery prices have gone up. Petrol has gone up. Housing costs have gone up.

Without diving into the numbers too far, the most important thing to remember when we talk about cost of living is that the rising price of essential goods and services impacts people very differently. Keep that term essential in mind.

For example, for an affluent person who spends a higher proportion of their income on holidays, cost of living increases may be a mild inconvenience rather than an absolute disaster.

However, if you’re a worker on a low salary and you’re already struggling to pay for essential goods and services (also known as ‘non-discretionary spending’) like rent, food, fuel and healthcare – a drop in real wages is far more severe. You can’t just feed your family less food or save fuel by not driving to work.

For the average Australian worker, missing out on $70 a month isn’t just a rounding error or a slightly cheaper holiday. And it’s certainly not just a tightening of the belt. It’s a tank of fuel, a trolley of groceries, a trip to the doctor, new school shoes for the kids, replacing broken tools, or paying the rent.

It’s essential. And now it’s gone.

Under the Morrison Government, workers have never been worse off

Workers got us through this pandemic, not politicians. But how does the Morrison Government reward us? By going missing while wages slide backwards.

These are the worst pay cuts workers have faced in over 20 years. Worse still, the Reserve Bank of Australia predicts inflation will continue to outstrip wages until at least the middle of this year.

Morrison could be working with unions to create wage growth and more secure jobs. He could be asking the Fair Work Commission to give low paid workers a proper pay rise. He could be working with employers to deliver decent wage rises. Instead, he’s out there welding as terribly as he plays the ukulele, desperately fumbling for the next photo op.

This Government has never delivered real wage growth for working people. Now it’s serving real wage cuts.

But there is hope. Union members enjoy higher wages than non-union members.

SHARE:

Cost of living isn’t just a numbers game, it affects real people