The unabridged version of this article was originally published in Stephen Dover’s LinkedIn Newsletter Global Market Perspectives. Stephen Dover, CFA is Chief Market Strategist for the Franklin Templeton Institute – Partnervest is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

With surging inflation amid record-low unemployment over the past 18 months, discussions about “secular stagnation” have receded into the background. However, today’s high inflation stems from severe supply-side shocks (war, sanctions) and interruptions to supply chains (due to the pandemic), coupled with large but temporary increases in spending (fiscal stimulus, pent-up demand as pandemic lockdowns ended).

Given these factors, the focus on inflation, while justified given its acceleration and breadth, may nevertheless distract attention from longer-term drivers of growth, inflation, and interest rates. In short, secular stagnation may still be the driving force impacting long-run outcomes for asset values.

What is secular stagnation?

Secular stagnation is a prolonged period of chronic underinvestment in productive enterprises (investment in plant, equipment, and new technologies) relative to the amount of savings in the economy. Secular stagnation leads to both a lower trend rate of growth as the “supply side” grows more slowly and to a deficiency of demand as excess savings imply a shortfall of spending in the economy. As a result, the economy tends to produce underemployment, low inflation, and very low real and nominal interest rates.

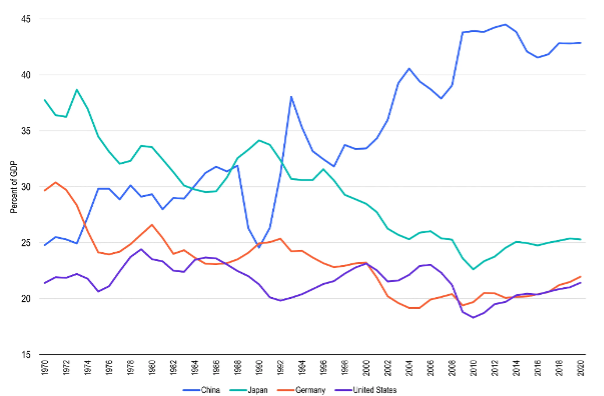

If we look more closely, we can see troublesome signs that secular stagnation remains a credible description of broad economic trends. For example (Chart 1), gross fixed capital formation as a percentage of gross domestic product (GDP)—a measure of total investment spending in the economy—has been declining in advanced economies (i.e., United States, Germany, and Japan) since the 1970s and, despite some recovery over the past decade, remains below average investment rates seen in the 1980s, 1990s or early 2000s.

Chart 1: Weaker worldwide investment spending

Total Investment Spending

Source: Franklin Templeton Institute, FAO, Macrobond.

Important data provider notices and terms available at www.franklintempletondatasources.com

Even in China – the world champion of capital expenditures over the past quarter century – rates of investment peaked nearly a decade ago and have been gradually receding ever since.

The world cannot be characterized as experiencing a boom in capital expenditures. Rather, large swathes of the global economy are seeing evidence of weak capital formation, a story that may also be unfolding in China.

What are the implications for interest rates?

Secular stagnation implies a very low, perhaps even negative, equilibrium real interest rate. That is because to generate full employment, borrowing costs must be sufficiently low to induce business investment that might not otherwise take place because of weak demographics, spluttering innovation or general perceptions of a diminished future.

Although the Federal Reserve and other central banks today are now hiking interest rates to lower current high rates of inflation, they cannot completely ignore the implications of very low long-run equilibrium interest rates. Slowing demand and curbing spiking inflation today are necessary, but overdoing things could be very damaging.

What are the implications for markets?

Secular stagnation, if it persists, presents investors with significant challenges, many of them already familiar from the past decade. After their recent jump, interest rates on risk-free assets, such as US Treasuries, will likely revert to much lower levels. That will recreate challenges for income-oriented investors.

Weak GDP growth implies that profits growth will also be pedestrian. Moreover, if profit share in GDP remains elevated political pressures stemming from income and wealth inequality will only increase.

Growth styles which favour the relatively few companies that can sustain high earnings over time (including via monopoly or oligopoly power) appear likely once again to outperform value and cyclical styles that are offer fewer profit opportunities in a world of secular stagnation.

Finally, low interest rates may again spur unproductive speculation in the customary places, including property markets or cryptocurrencies, or in new ones devised to capture the allure of high returns.

Building Diversified Portfolios – Understanding Asset Classes

At Partnervest, we create diversified portfolios based on a careful analysis of the underlying exposures within each asset class. These portfolios are then dynamically adjusted based on the relative attractiveness of different each asset class given the prevailing economic conditions, whilst maintain targeted risk and return parameters.

Our online platform is designed to make it easy for you to allocate your cash to a portfolio of carefully selected investment products designed to harness the benefits of diversification, and specified to target risk and volatility levels.

In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

Endnotes

- Source: “Bonds in line for worst year in decades.” Reuters, June 30, 2022.

- Source: Analysis by Franklin Templeton Institute, Bloomberg.

- Source: Bloomberg.

- Source: Analysis by Franklin Templeton Institute, Bloomberg.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Important Information

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

SHARE:

“Stagflation” & the shifting economic narrative