Written by Stephen Dover, CFA Chief Market Strategist, Franklin Templeton Institute – Partnervest is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Over the last few years when non-dividend paying growth stocks were delivering significant double-digit gains in the span of months, it was easy to ignore the benefits of equity income. Given rising interest rates, slowing growth and heightened volatility, this is likely to change as investors reassess the role of dividends amid a more challenging environment for multiple expansion.

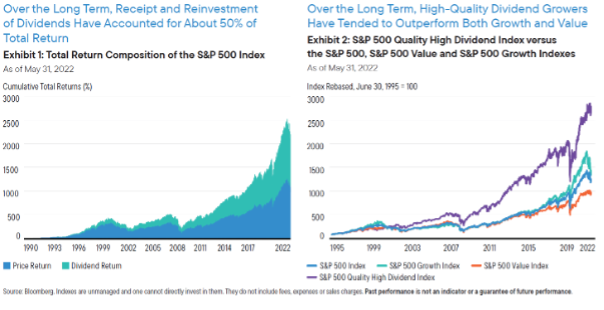

Over the long-term, dividends have proven to be a significant driver of total return. Over the last 31 years, spanning January 1990 through December 2021, the receipt and reinvestment of dividends accounted for about 50% of the cumulative total return of the S&P 500 Index. In addition, dividend growers, proxied by the S&P 500 Quality High Dividend Index, have outperformed their value and growth counterparts over the more than two decades since 1995.

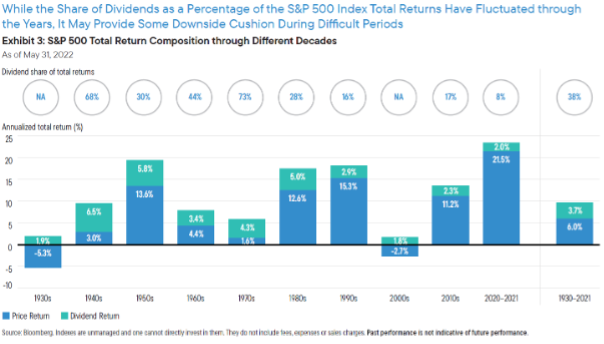

Reinvested dividends tend to provide a downside cushion for total returns during periods of modest capital gains. The 2000s—the “lost decade” for stocks—is a crucial case-in-point. While the S&P 500 delivered annualized total returns of –0.95% in the10 years from January 2000 through December 2009, the figure would have been worse had dividends been removed from the calculation. Annualized price return for the index in the 2000s averaged –2.72% versus dividends, which provided 1.77% annualized return over the 10-year period.

More than just a return cushion, dividend payouts can also act as a useful quality barometer. A solid track record of growing dividends consistently and sustainably over an extended period of time is typically seen as a signal of healthy company fundamentals, astute and efficient capital allocation and a firm commitment to shareholder value. Overall, it may be a useful indicator of better-quality assets, although this is not the only metric to aid in such assessments.

Adopting a bottom-up approach to stock selection is critical, in our view, to ensure exposure to high-quality names that have the potential to become reliable sources of income across business cycles. Dividend payouts are often cut during periods of grave economic stress, particularly in the most vulnerable companies. We believe active management is especially useful to help investors maintain a quality bias and stay nimble when navigating a potentially rocky market terrain ahead.

Consider quality dividends in your search for income

Against a backdrop of elevated market volatility and economic uncertainty, we believe investors should strongly consider a quality bias and search for dividend income in a diversified and thoughtful manner. Judicious and rigorous bottom-up equity selection remains crucial, in our view, as the yield potential of a stock may be underpinned by various idiosyncratic factors that extend well beyond the typical macro drivers. Understanding the nuances of a company’s business model as well as the economic and political environments in which they operate will be critical. Opportunities are plentiful amid the market volatility, but investors should remain prudent in the hunt for yield.

—

Building Diversified Portfolios – Understanding the Ingredients

At Partnervest, we create portfolios comprised of multiple index and fund products based on a careful analysis of the underlying exposures within. By doing this, we are able to craft portfolios that have asset allocations that are diversified based on the logic of fundamental risk exposures and correlations.

Our online platform is designed to make it easy for you to allocate your cash to a portfolio of carefully selected investment products designed to harness the benefits of diversification, and specified to target risk and volatility levels. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Important Information

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

SHARE:

Three reasons why now may be time for dividends