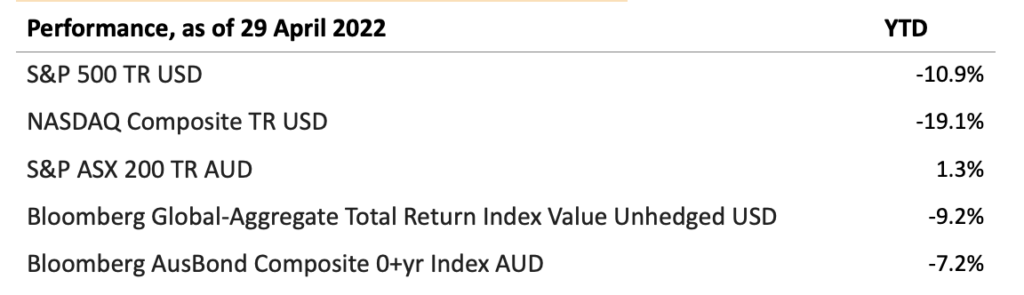

Global stock and bond markets have fallen on hard times since the start of the year. A quick glance at the year-to-date returns of major global indices bears out:

Major Indices Year to Date Performance as of 29 April, 2022

With such a difficult start to the year, many investors are questioning their investment allocations, and some are even wondering if they should be hiding everything under their mattresses.

In the world of investing, it never pays to panic but, at the same time, fear of loss is only natural. One way to avoid the human impulse to panic is to look beyond the short-term to what markets have provided investors willing to ride out short-term volatility.

For example, the average annual investor returns for the S&P 500 from 1937 to 2021 was 10.7%, 65 of these 85 total years (76%) produced positive returns. Clearly, staying invested in the market worked out for long-term US equity market investors. What’s more it is often much more tax efficient to be a long-term investor as well.

Stock or Bond? Try Both – The Benefits of a Diversified Portfolio

With both stock and bond markets on the back foot, it’s natural to ask which asset class an investor should be in. The answer is most often both.

For all but the most aggressive and conservative investors, a mix of both stocks and bonds is usually the optimal portfolio. This is because stocks and bonds have different cash flow characteristics that lend themselves to a more stable return stream over time.

Bonds tend to outperform stocks in a disinflationary environment because their cash-flows are relatively more secure and of a fixed amount. Stocks, on the other hand, tend to outperform bonds in moderate inflationary environments because their cash-flows are linked to corporate earnings and the strength of the wider economy.

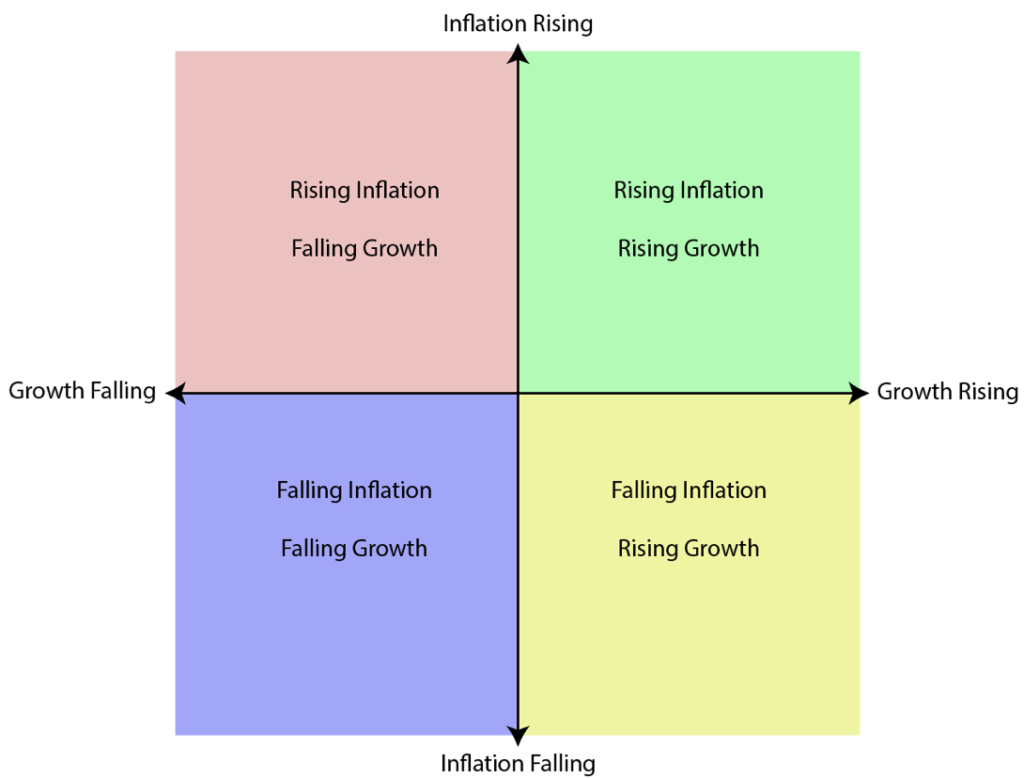

Economic Environments for Crafting Diversified Portfolios

Ideally, a portfolio will be diversified so that it has investments that can offer return characteristics for different economic environments. If this is done well, the portfolio may produce an overall more balanced mix of volatility and return for an investor over the full course of their investment experience.

Building Diversified Portfolios – Understanding the Ingredients

At Partnervest, we create portfolios comprised of multiple index and fund products based on a careful analysis of the underlying exposures within. By doing this, we are able to craft portfolios that have asset allocations that are diversified based on the logic of fundamental risk exposures and correlations, rather than just the whims of market pricing dynamics.

Our online platform is designed to make it easy for you to allocate your cash to a portfolio of carefully selected investment products designed to harness the benefits of diversification, and specified to target risk and volatility levels. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Important Information

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

1 – Source: Morningstar, Franklin Templeton, Past performance is not a guide to future returns.

2 – Source: Franklin Templeton, Past Performance is not a guide to future performance. Performance shown reflects the effects of dividend reinvestment. The S&P 500 Index (S&P 500) is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. Performance does not reflect the impact of fees and expenses. Investors cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or other charges.

SHARE:

Fade the Fear – Why Tough Times are No Time to Panic