Interest rates are rising both here in Australia and across the globe. Because bond prices (and returns) are inversely related to interest rates, this generally means a poor environment for fixed income returns. Thus, investors may be asking themselves whether now the time is to get out of fixed income?

As usual, however, panic and knee-jerk reactions are the wrong thing to do when it comes to investing. This is because not all interest rates move together or to the same degree. As such, a diversified fixed income portfolio is especially important during a rising interest rate environment.

What’s Happened & Why is it Happening?

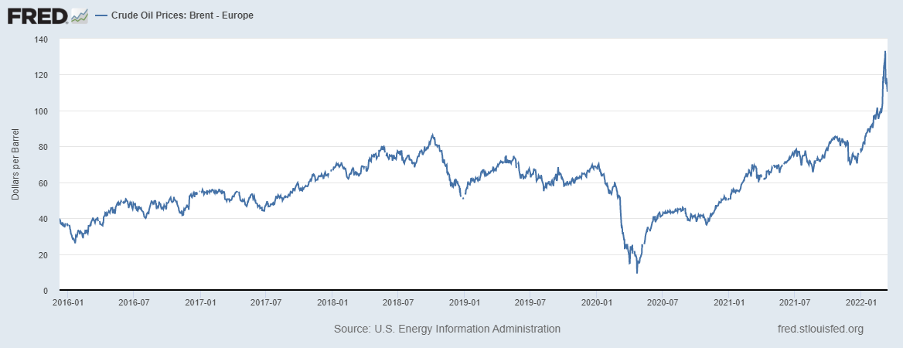

Strained global supply chains and the shocks to commodity markets stemming from the war in Ukraine have only increased the upward pressure on prices and inflation. This in turn increases the need for central bankers to reduce the demand pressure within their respective economies by rising interest rates.

In March, the Federal Reserve Board of the United States raised interest rates for the first time since 2018. Here in Australia, RBA Governor Lowe commented that it would be “prudent” to expect that the RBA will hike rates this year, as well. Bond markets are anticipating further interest rate hikes from both the RBA and FED over the course of the next year.

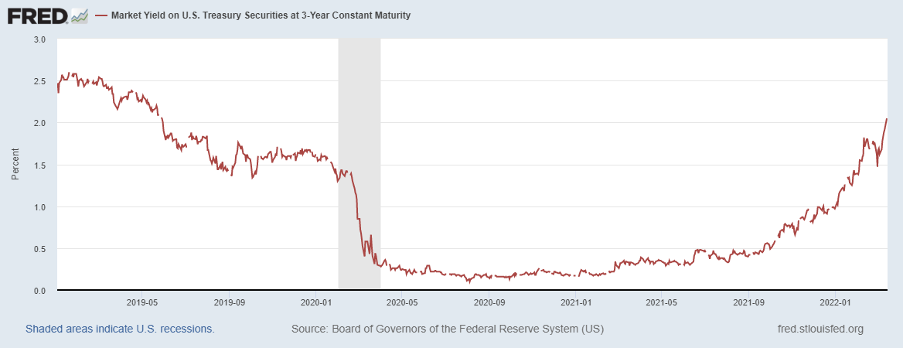

This has led short-term interest rates to rise. For example, the Australian 3-year government bond has risen from 0.34% to 1.90%, from October 2021 to March, 2022[1]. In the United States, the US 3-year government bond has risen from 0.49% to 2.04%, in the same period[2].

What does this mean for investors?

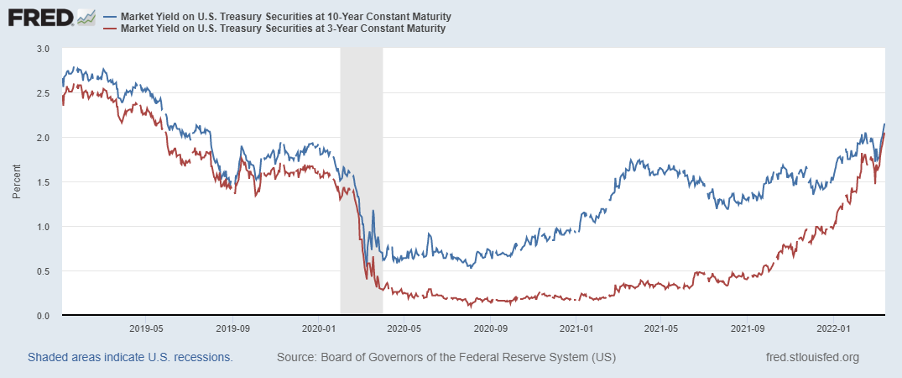

At first glance, the rise in interest rates would seem to merit alarm for anyone holding fixed income investments, but the reality is less dramatic than just looking at short-end bonds would suggest. This is because while short-end interest rates have posted dramatic moves, long term interest rates have remained relatively stable.

In the below chart, the red line shows the performance of the 3-year US Government market yield versus the 10-year government bond in blue. The red line, the 3-year bond, has risen in yield much more dramatically than the 10-year bond.

The different performance of these two bonds can be largely attributed to the fact that, the 3-year bond is much more sensitive to short-term inflation, while the long-term bond takes into account investors’ expectations for inflation over the longer-term.

This difference in sensitivities is why it is often worthwhile to have exposure to fixed income investments of different maturities, country, credit, and currency exposures. Holding all your fixed income investments in short-dated instruments within Australia, for instance, would place you at greater risk from a short-term inflation spike.

The Benefits of a Diversified Fixed Income Portfolio

At Partnervest, we construct portfolios designed to harness a broad range of fixed income exposures to maximise the benefits of diversification within the asset class. This includes exposure to short and long dated interest rate securities, corporate bonds and other credit instruments in Australia and across the globe.

Our online platform is designed to make it easy for you to allocate your cash balances to a diversified portfolio of both stocks and bonds. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

[1] Source: PartnerVest, Investing.com

[2] Source: PartnerVest, fred.stlouisfed.org

SHARE:

Rising Interest Rates Highlight the Benefits of Diversified Fixed Income Investing