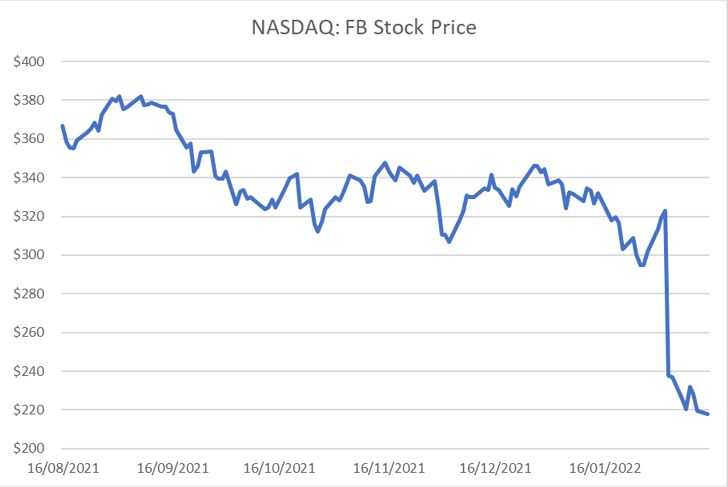

Anyone with an eye on financial markets would not have missed the shockwave that occurred when Meta Platforms (previously Facebook), (NASDAQ: FB) stock suffered a serious decline due to lower customer engagement figures and declining advertising revenue projections.

We all know that the stock market can be a volatile place to invest but it can still be easy to forget just how wild a ride investing in individual stocks can be. In Facebook’s case, the stock lost over 20% following the earnings release and is, as of this writing, down over 30% from its average trading price over the past six months. This equates to a loss of over $150 billion in market capitalization for the company.

The Risks of Individual Stocks

Facebook’s sharp decline is a timely reminder that investments in even the largest and seemingly powerful companies can present substantial risks to investors long-term wealth creation if not managed properly.

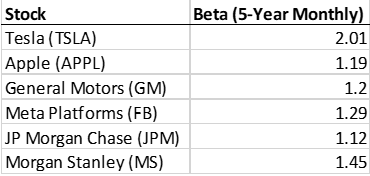

This is because individual stocks are on average much more volatile than the stock market overall. One measure of how much more volatile an individual stock has been relative to the overall market is a metric called Beta.

A stock with a Beta of 1 means it has been equally volatile as the overall stock market over the measurement period. The higher a stocks beta the more volatile it is, and the lower a stocks beta, the less volatile it has been relative to the overall market, historically.

Due to diversifications dampening affect on volatility, even the largest and most popular stocks are often more volatile than the market. For example, the below chart displays a few house-hold-name stock’s Beta measurements relative to the S&P 500.

The Benefits of Diversification & the Partnervest Approach

One time-tested method for reducing investors exposure to individual company risk is to diversify stock market exposure across a basket of stocks, commonly known as an Index Fund. The most famous stock index and associated structure is the S&P 500 which is constructed by passively weighting stocks by their market capitalization.

There are, however, many varieties of index construction and degrees of active management beyond the simple methodology and passive approach of the S&P 500. These alternative financial products can allow investors both the benefits of diversification and the expertise of investment experts selecting attractive investments. As with all investments, which index or fund type to use comes down to a careful cost benefit analysis and examination of the full range of offerings.

At Partnervest, we employ a team of seasoned investment professionals to identify attractive passive and index opportunities that combine to deliver stock market exposure for our clients. We have built an online platform that is specifically designed to make it easy for you to allocate your cash balances to a diversified portfolio of stocks and bond. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently is more important than ever.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Important Information

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

[1] Source: Partervest, Yahoo Finance, past performance is not a guide to future returns

[2] Source: PartnerVest, Yahoo Finance, past performance is not a guide to future returns

SHARE:

The Lessons of Facebook’s (now Meta) Problems for Building Wealth