Australia’s wealthiest dodging billions in tax

Imagine you are mega wealthy. Like yacht-sailing, multiple-house-owning, millionaire CEO level of wealthy.

Normally, you have to pay quite a bit of tax (provided you follow the rules). In Australia, the higher your income bracket, the more tax you pay.

But you’ve just realised something. Your superannuation is taxed at the same rate, regardless of the amount. Surely the best move is to put your millions into a super fund so you pay less tax, right?

Right. That is exactly what’s been happening.

Tens of thousands of the extremely rich have dumped money into their super funds to pay less tax on their investment returns. But that type of hoarding will soon become harder to do.

Wait, what do you mean super is taxed?

If you have a superannuation fund and you’re not yet retired then all your money earned in super is taxed. At the moment – no matter if you have $10,000 or $10 million in super – the tax paid on your investment returns before you retire is 15 per cent.

Not a millionaire? Then here is some good news

There’s been a whole heap of buzz around superannuation since the Albanese Government announced changes to the tax rate on earnings.

The key takeaway: the tax rates will double to 30 per cent for people with super balances of more than $3 million. Not immediately – the increase will happen from mid-2025.

So what?

The change is a big deal. Not because it affects many people’s balances, but because it’s a move in the right direction to address superannuation inequality.

How much hoarding is happening?

It’s a small number of people but it’s a huge amount of wealth.

And before you ask – no, we do not know the identity of the one person who has more than $540 million in super.

For a typical worker who is about 30 years old with about $50,000 in superannuation to get to $3 million in retirement savings at 67, you’d need to save an extra $43,000 a year in superannuation, on top of your employer’s contributions.

How you should be benefitting from super

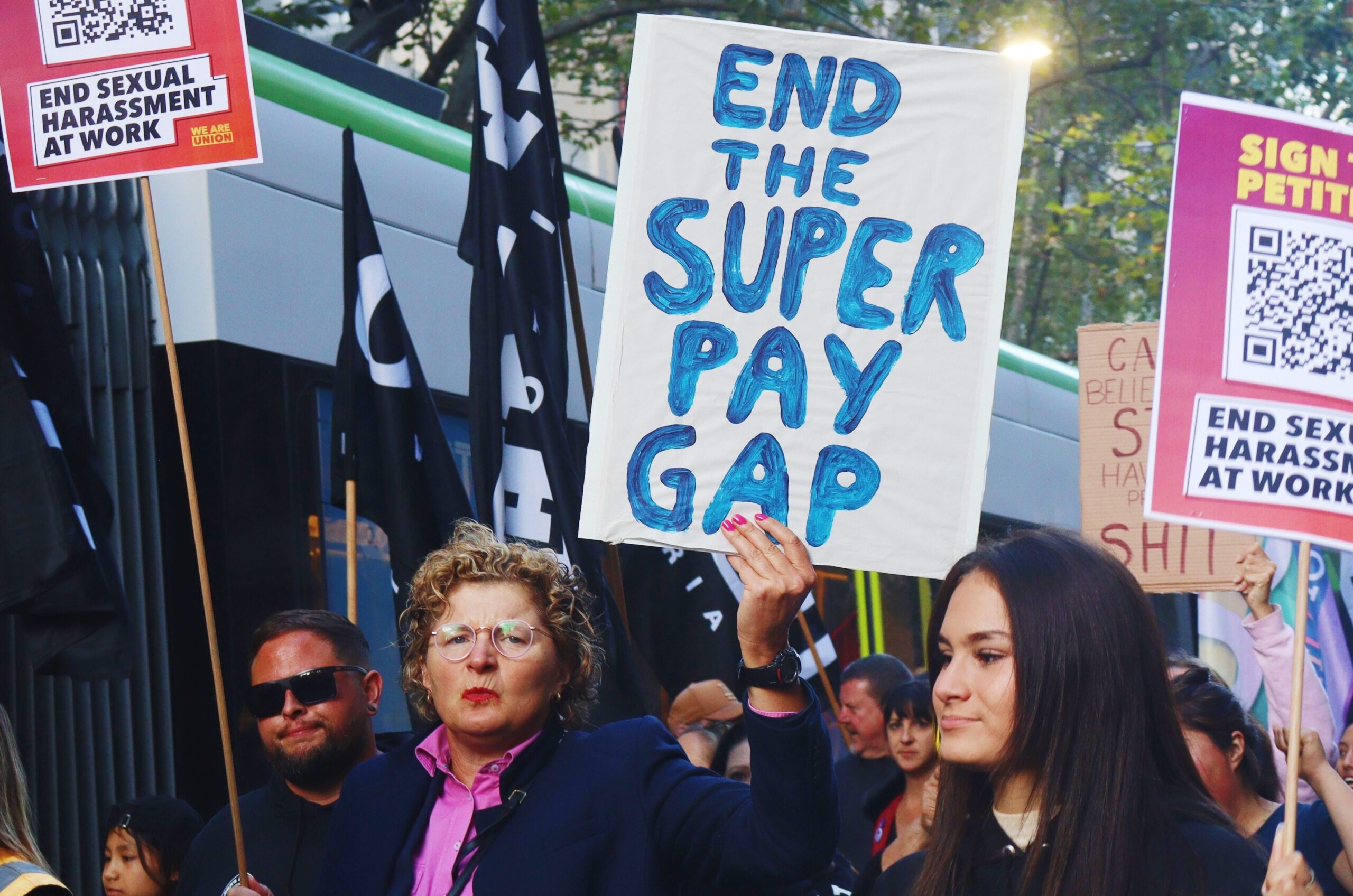

What the superannuation system is like now, is so not what was originally intended. The union movement won super so that every Australian was provided with a dignified retirement through a fair and equitable system.

That vision is why the union movement now advocate for a fairer superannuation system that sees women retire with equality, Aboriginal and Torres Strait Islanders retire with equitable access and benefit, and all workers enjoy a dignified retirement.

The super system was never meant to be manipulated by Australia’s wealthiest people so they could dodge tax. Fortunately, the recent tax change is a step in the right direction in fixing the inequality baked into the system.

There are already ways you can improve your super

While we can’t guarantee you’ll have $544 million in your super account when you retire, these are some factors that contribute to a good super balance:

- Higher wages (which automatically mean higher super contributions)

- Superannuation paid on parental leave – including periods of unpaid parental leave

- Better super contribution rate in your enterprise agreement

It’s incredibly difficult to achieve any of the above on your own. But being in a union makes it far easier because:

- Union members on average earn 26 per cent more than non-members

- Union members bargain to have superannuation paid on parental leave. It doesn’t get paid unless you have it in your agreement

- Union-backed agreements often mean you’re paid more than the superannuation guarantee. The super guarantee is currently at 10.5 per cent but unionised workplaces in blue-collar and white-collar industries have achieved far higher rates.

In other words, being in your union is the best way for you to achieve a fairer deal on super. By coming together as union members, you and your workmates can make massive gains for wages, super and working rights.

Cover photo credit: Roman Kraft on Unsplash

SHARE:

Tax on superannuation? Find out what the latest changes mean for you