Campaigns

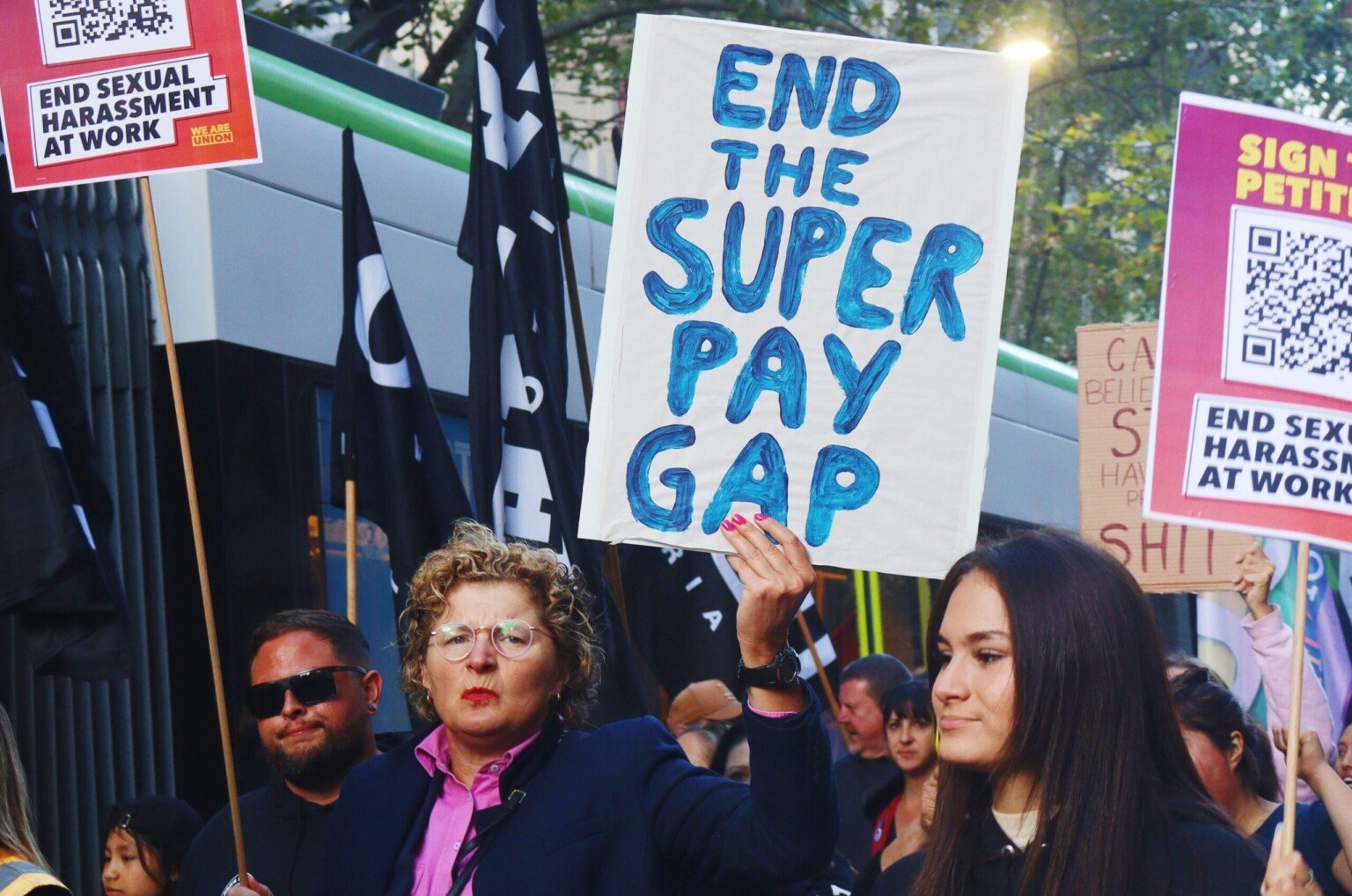

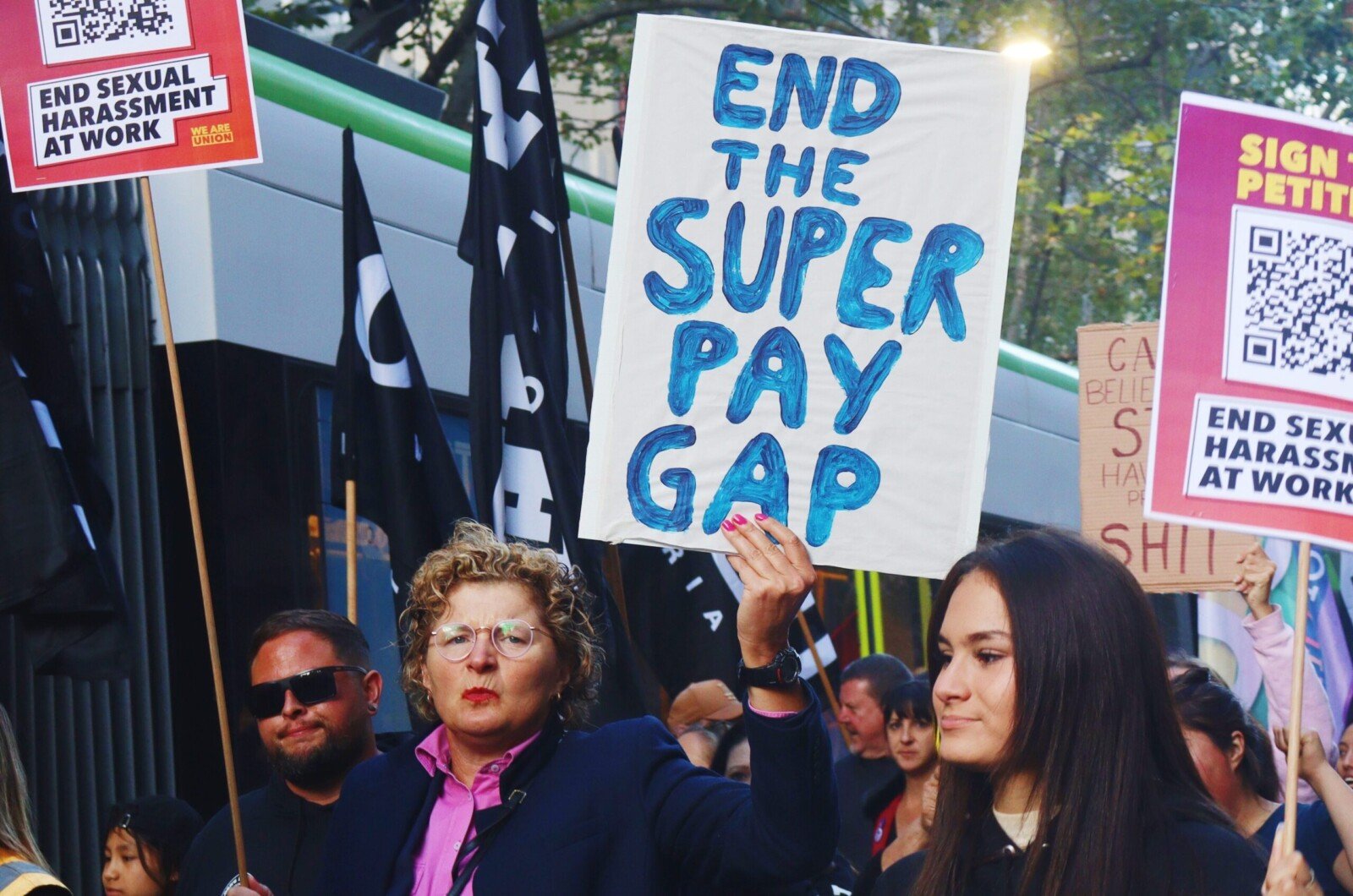

Unions are built on the power of collective action, and our campaigns reflect the strength and solidarity of workers.

Union members are always advocating for better wages, stronger workplace protections, fair job security and safer working environments.

Join us: campaigns are driven – and won – by the voices of workers who unite to demand change. Every voice counts.

These campaigns are how we improve the lives of workers, ensuring fair treatment and opportunities for all.

12 Festive Fails: Santa's Naughty List 2025

Our guide has the lowdown on your workplace rights this Christmas and how to stand up for them.

Get the guide

It’s For Every Body

It’s time all workers had access to ten days of paid leave per year to manage their reproductive health.

Read More

Everyone should pay their fair share of tax

We need reform that closes loopholes and ensures everyone pays their fair share.

Read more

Everyone deserves a secure future through affordable housing

We cannot give investors tax supports while ‘owning your own home’ gets further out of reach for workers.

Read More

Adult Age, Adult Wage

If you’re over 18, you're are adult in law, but not in pay. You should be earning an adult wage.

Read More

Eradicate asbestos

It’s been 20 years since asbestos was banned in Australia, but sadly the threat hasn’t gone away.

Read More