Inflation has been on investors’ minds since the beginning of 2021. The combination of government stimulus and the supply chain disruptions caused by both changes in consumer behaviour (online shopping) and COVID-19 policies resulted in strong consumer demand and weakened supply chains. This in turn has resulted in price pressure for everything from shipping containers to oil and even for labour itself.

Global Price of Energy Index (2015-2021)

Up until recently, financial markets had assumed that the supply chain would sort itself out as COVID restrictions eased and do so before the end of the year and build-up to the holiday season.

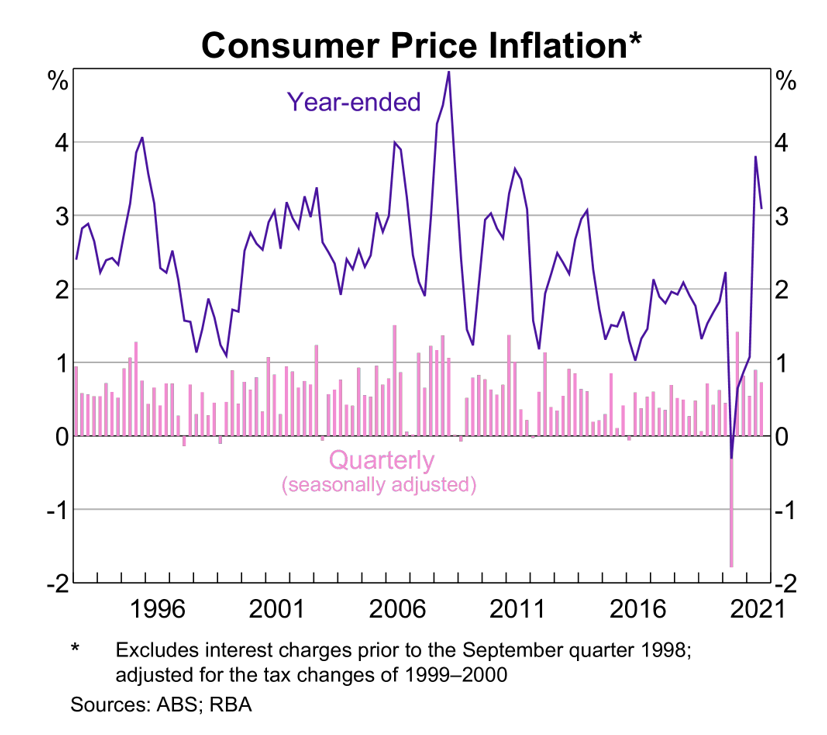

Unfortunately for consumers, these assumptions proved to be too optimistic and recent inflation data from both Australia and abroad has been showing worryingly high and persistent inflation.

Australia Consumer Price Inflation (1996 -2021)

Rising Yields & Falling Bond Prices

The result of this inflation pressure has been falling bond prices and rising interest rates both here in Australia and in many global bond markets as well. Indeed, the past three months have witnessed a dramatic change in Australian inflation expectations and short-dated Australian interest rates. For example, the yield to maturity of the three-year Australian Government Bond has jumped from 0.20% in August to almost 1.00%, as of this writing[1].

At Partnervest, we believe these recent market dislocations should be seen as a timely reminder to investors on two important aspects of intelligent investing. The first, is the potential dangers of and overallocation to cash. And the second, is the need to build an intelligently diversified portfolio.

Inflation Implications for Portfolios & Cash

Inflation is like the treadmill that all investors run on, and the rate of inflation is the speed at which its going. The higher the level of inflation, the faster your portfolio must run just to keep you in the same place.

For example, if inflation is at 6% p.a. then your portfolio must return 6% p.a. just to maintain its purchasing power and must earn even higher returns to increase your real wealth and likely achieve your investment objectives.

In an inflationary environment, cash is often the worst performing asset class because it has no inherent return and doesn’t produce any intrinsic cash-flow stream. Therefore, investors who are sitting with idle cash balances have historically been the worst hit by inflation.

The Case for Diversification

As noted previously, the past three months have seen a dramatic rise in short-term interest rates and corresponding fall in bond price. And while investors should not focus on short-term performance, these price declines are a timely reminder that even relatively safe asset classes can experience short-term volatility.

By building a diversified portfolio of asset classes with different risk and return characteristics, its possible to lessen the impact of any specific asset class on the overall portfolio. It may also be possible to mitigate the impact of an inflationary scenario by crafting a portfolio with investments that have varying responses to inflation. For these reasons, building a diversified portfolio is one of the most important things an investor can do to maximise the odd of achieving their wealth objectives.

Protect and Build Your Wealth with Partnervest

At Partnervest, we have built an online platform that is specifically designed to make it easy for you to allocate your cash balances to a diversified portfolio. In a world of rising uncertainty with respect to inflation and rapidly changing markets, knowing that you can invest your wealth quickly, easily, and intelligently is more important than ever.

To learn more about how you can start building a sound financial future, visit our website at https://partnervest.com.au/.

Important Information

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Important Information

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

[1] Sources: RBA, YieldBroker

SHARE:

Falling Bond Prices and Rising Yields – What’s Inflation Got to Do with It?