The unabridged version of this article was originally published in Stephen Dover’s LinkedIn Newsletter Global Market Perspectives. Stephen Dover, CFA is Chief Market Strategist for the Franklin Templeton Institute – Partnervest is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Economic and political dislocations, recession fears, high inflation and aggressive monetary policy tightening have roiled markets in 2022, producing one of the worst half-year results for global investors since the early 1970s.1 Even if the worst of the market setbacks are behind us, volatility and uncertainty will likely linger.

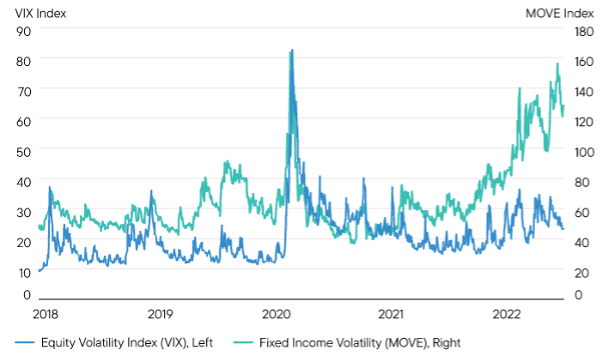

Notably, volatility in the bond market is unusually high relative to stocks (Exhibit 1). Inflation and fears about the Federal Reserve’s (Fed’s) tightening cycle are partly responsible, but so too is the large price impact associated with rising bond yields from very low starting levels.

When traditionally “safe” fixed income assets are leading the capital markets downward, this leads to questions on how to navigate an environment that has changed markedly from where it was just six months ago.

The answers depend on individual needs, preferences, and tolerances for risk. But in general, the solutions for many will be found in renewed opportunities in income and portfolio rebalancing.

Exhibit 1: Volatility Rising, Particularly for Fixed Income

United States: Volatility Indices as of July 25, 2022

Source: Analysis by Franklin Templeton Institute, S&P Indices, Macrobond.

Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Important data provider notes and terms

Understanding the role of duration in bond and stock markets

The concept of duration is an important to consider when taking a deeper look at the underlying factors driving asset prices and market volatility.

Duration can be simply defined as the expected holding period of an asset. The longer the duration, the greater the risk (sensitivity to interest-rate changes) and hence, the required compensation an investor ought to demand.

That’s why, for example, bonds that mature further in the future typically offer higher yields than those with shorter maturities. Moreover, to the extent that payoffs from a long-duration asset arrive much later, as is the case with longer-maturity bonds or growth stocks, their prices will be more sensitive to changes in interest rates.

Duration risk: not just for fixed income

While most investors typically associate duration with fixed income investments, its relationship to stocks is also relevant. For instance, when investors pay high prices for growing companies that are unprofitable today, they are presuming those companies will eventually earn enough to justify higher valuations. In effect, they are partaking in future, not present, profits and dividends.

It follows that the conditions that favour long duration are often the same for growth stocks and bonds, above all, the presence of low or falling interest rates. In 2022, interest rates have risen as markets anticipate significant monetary policy tightening to combat high inflation. Unsurprisingly, longer duration bonds and growth stocks have fared poorly.

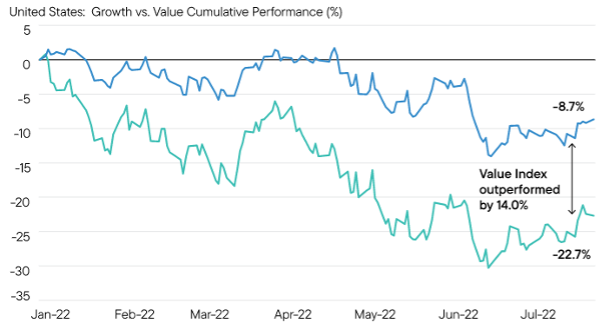

Against this backdrop of duration underperformance and rising volatility, it is not surprising that growth stocks have also underperformed, particularly relative to value stocks (Exhibit 2).

Exhibit 2: Growth Broadly Underperforming Value in 2022

As of July 25, 2022

Sources: Analysis by Franklin Templeton Institute, S&P Indices, Macrobond.

Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Important data provider notices and terms

Looking at the duration of equities is more important than ever

Naturally, dynamic rebalancing requires continuous assessment of market prospects, above all, for Fed policy, inflation, and growth. To the extent that inflation may soon peak, and growth slows, extending duration makes sense, even more so if coupled with income derived from shorter duration notes and bonds. That combination may be preferable to taking credit risk, in my view.

Using free cash flow as a proxy for bond yields, duration explains the year’s underperformance of last year’s best performers (the FAANGM group of Facebook, Apple, Alphabet, Netflix, Google, and Microsoft) in the S&P 500 Index, which have a duration much higher than the rest of the index.

Allocation opportunities within fixed income are expanding

Rising interest rates pose risks, as has clearly been on display in 2022. But they also pose opportunity via income and rebalancing. Duration in stocks and bonds will remain under pressure until fundamental and technical factors (i.e., both inflation and policy risk) have run their course.

Dynamic rebalancing can increase returns per unit of risk and deliver better income opportunities for investors. The bottom line is that changing fundamentals warrant revisiting portfolios to ensure that allocations remain consistent with investors’ risk appetites and return expectations.

Building Diversified Portfolios – Understanding Asset Classes

At Partnervest, we create portfolios that span asset classes based on a careful analysis of the underlying exposures within. These portfolios are then dynamically adjusted to consider the relative attractiveness of different each asset class given the prevailing economic conditions, whilst maintain targeted risk and return parameters.

Our online platform is designed to make it easy for you to allocate your cash to a portfolio of carefully selected investment products designed to harness the benefits of diversification, and specified to target risk and volatility levels. In a world of rising uncertainty and fast-moving markets, having a partner that can help you invest your wealth quickly, easily, and intelligently can make all the difference. To learn more about how you can start building a sound financial future, visit our website.

Endnotes

- Source: “Bonds in line for worst year in decades.” Reuters, June 30, 2022.

- Source: Analysis by Franklin Templeton Institute, Bloomberg.

- Source: Bloomberg.

- Source: Analysis by Franklin Templeton Institute, Bloomberg.

IMPORTANT INFORMATION

* You also need to maintain a balance of at least $2500 in your Cash Hub at all times.

All investments carry risk. Before deciding to invest, you should consider the following key risks:

• The value of investments will vary. You can lose money as well as make money.

• The level of returns will vary, and future returns will differ from past returns

• Returns are not guaranteed and investors may lose some or all of their money, and

• Laws change.

Past performance is not an indicator of future returns. Issued by Partnervest, a division of Franklin Templeton Australia Limited (ABN 76 004 835 849, AFSL 240827).

Before making an investment decision you should read the relevant Product Disclosure Statement (PDS) carefully and you need to consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting Partnervest on 1800 679 541 or at www.partnervest.com.au.

The information in this presentation is of a general nature only and is not intended to be, and is not, a complete or definitive statement of the matters described in it. The information does not constitute specific investment advice and does not include recommendations on any particular securities. Franklin Templeton Australia Limited nor any of its related parties, guarantee the repayment of capital or performance of any of the Franklin Templeton trusts referred to in this document. Although statements of fact in this presentation have been obtained from and are based upon sources Franklin Templeton Australia Limited believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this communication constitute our judgement as of the date of this communication and are subject to change without notice.

SHARE:

How duration affects stocks and bonds